Minibook

Opportunities for Blockchain Technology in Capital Markets

Learn from early adopters, gather strategic insights and explore best-in-class use cases.

Discover how blockchain technology and asset tokenization are transforming capital markets.

Co-authored by

What's inside

Grasp the benefits of blockchain

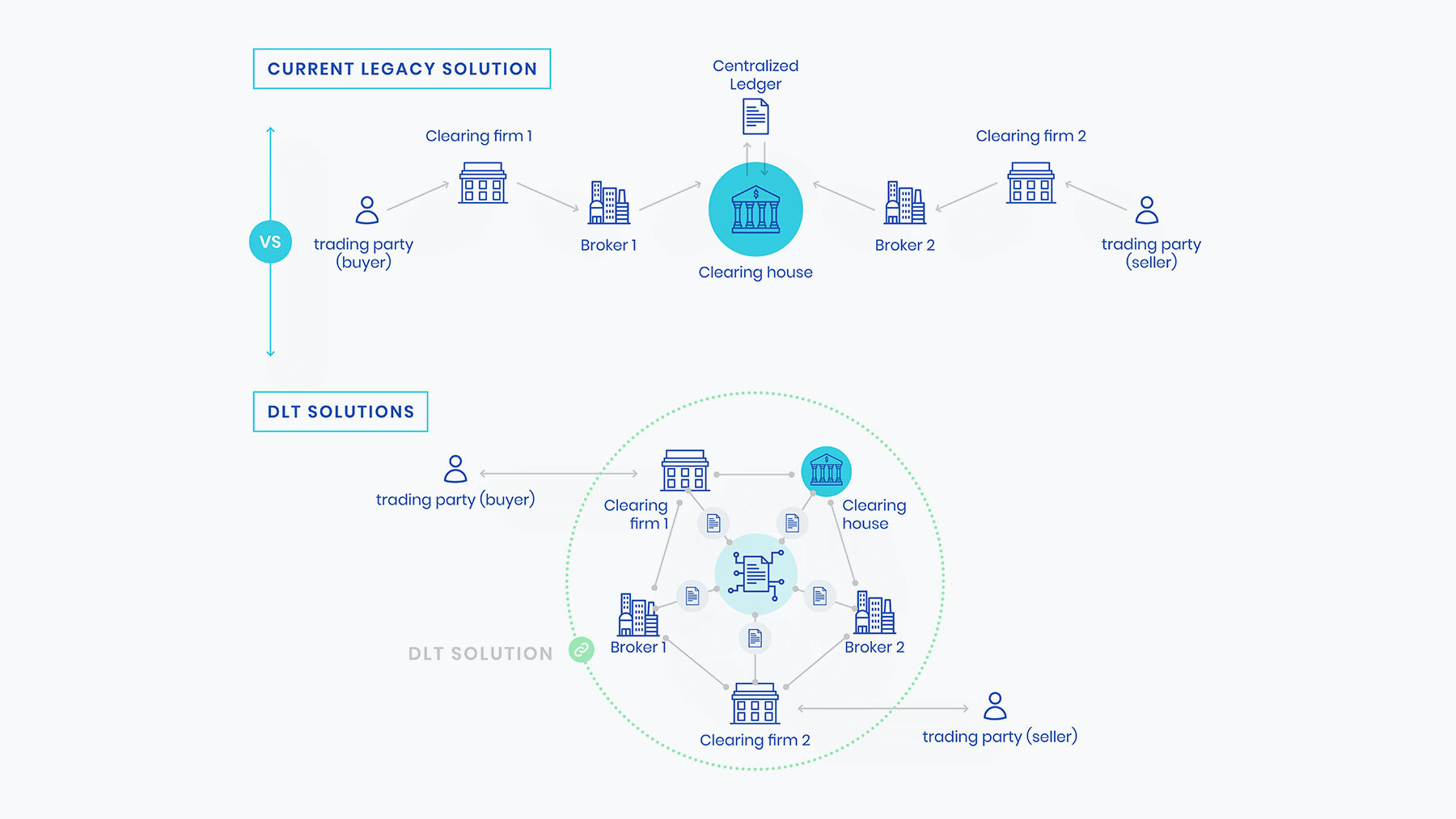

Blockchain solutions can improve:

- How asset ownership is recorded

- How trust between parties is established

- How transactions are executed

They can lead to reduced counterparty risk, lower operational costs, improved balance sheet management and more. Understand how the technology works from a first principles perspective and get an overview of possibilities.

Identify your role in the blockchain-based capital markets of the future

The shift to blockchain-based capital market necessitates the emergence of new roles including digital asset vaults, asset tokenizers, cash-on-ledger issuers and more. Get a complete breakdown of the emerging roles and understand where your organization fits in.

Discover what DeFi can teach us about capital markets innovation

Get an overview of the Decentralized Finance projects that are making waves. These present a model for one possible direction traditional markets might take in the coming years, as regulation catches up with the innovation that has occurred 'in the wild' already.

Understand the latest and greatest examples of blockchain in capital markets

From asset tokenization to central bank digital currencies (CBDCs), delve into the best blockchain-based solutions that are gaining traction in traditional capital markets right now. Understand where incumbents are investing and how new entrants are challenging the status quo.

" There’s now strong momentum for blockchain-based innovation across capital markets and within asset tokenization in particular. For organizations that don’t think they have the capabilities in-house to keep up, it can feel like blockchain innovation is out of reach. This doesn’t have to be the case. With SettleMint’s high-performance, low-code platform, every company can quickly and easily develop the blockchain applications they want tomorrow with the engineering skills they have today."

Matthew Van Niekerk - Co-founder & CEO SettleMint

Happy to share ideas for your use case in capital markets

Drop a message to matthew@settlemint.com or book a time slot for a chat here.

© SettleMint 2026 Privacy policy Cookie policy